Tight Liquidity Affects Treasury Securities

Experts fear that the government could be facing liquidity pressure to implement its operations following revelations that it managed to raise 34 percent of the applied amount, through various debt instruments, on the market.

A Reserve Bank of Malawi’s (RBM) weekly financial market developments brief for the week ending November 12 2021 indicates that commercial banks’ excess reserves before borrowing from the Central Bank averaged negative K94.5 million.

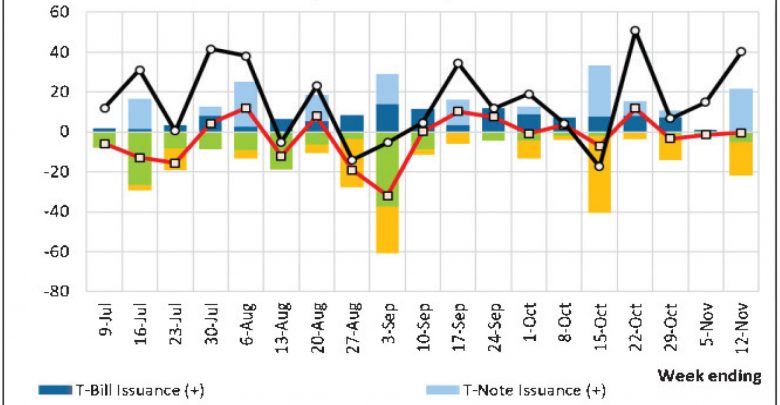

The brief shows that K0.1 billion was raised through treasury bills and K21.3 billion through treasury notes against the planned K62 billion.

This represents an allotment to planned issuance ratio of 0.78 percent for treasury bills and 47.41 percent for treasury notes with all bids accepted.

Commenting on the figures, Malawi University of Business and Applied Sciences (Mubas) economist Betchani Tchereni said the development may be a blessing in disguise as the rate at which the government is borrowing domestically will dwindle.

“You may note that there

has been a rise in inflation and it may continue. It is likely that banks’ interest rates are going to rise as well. Therefore, banks might be holding funds to lend government when interest rates are up than now when interest rates are low,” Tchereni said.

Market analyst Cosmas Chigwe said the problem is that commercial banks dominate the country’s treasury securities.

“My suggestion is that the country should consider putting mechanisms that will woo foreign investors into the securities market or RBM should use fiscal policies to contain the situation.

“Foreign investors shun putting their money in the securities market because we do not have a credit rating and we are regarded as a junk market. Therefore, until that is addressed, RBM can just use its capacity to inject money into the market even though it is inflationary,” Chigwe said.

In an earlier interview, Bankers Association of Malawi Chief Executive Officer Lynes Nkungula said the tight liquidity would continue.

SOURCE: THE TIMES GROUPS